Indicators on What Is Medicare (Part D) You Should Know

You will certainly require to have evidence of your age, such as a birth certification, your previous year's W-2 form or tax return, as well as potentially other proof. Call Social Safety and security in advance to figure out what proof you will need. There are a number of methods to enlist in Medicare: Automatic Registration, First Registration, General Enrollment, Special Enrollment.

Register in Medicare Part A when you transform 65 (remember: it is generally free!). When you, or your partner retires, or your active employment health and wellness insurance finishes, you have eight months to sign up in Medicare Component B without any penalty (medicare part d). Note: Health insurance offered as a senior citizen benefit are ruled out active work group health insurance plan.

Part-time or recurring knowledgeable nursing care, Physical and also speech therapy (limits)Medical social solutions, Medical products, Long lasting clinical equipment Medical professional and nursing solutions, Home wellness assistant and housewife services, Short-term inpatient care, Medical products, Physical, work-related, as well as speech therapy, Medications (to manage signs and symptoms and pain)Household counseling, Medical social services, Inpatient break care (to provide relief for the individual that typically gives care-- 5 day maximum remain) Physician solutions received in the physician's workplace, client's residence, healthcare facility, competent nursing center, or anywhere else in the United States, Medical and also medical services, consisting of anesthetic (inpatient and outpatient)Radiology as well as pathology services (inpatient as well as outpatient)X-rays, Medical supplies, Blood transfusions (after initial three pints)Lab examinations billed by the medical facility, Rescue coverage, Drugs as well as biologicals which can not be self administered, Outpatient health center solutions, Outpatient physical, occupational, or speech therapy, Outpatient maintenance dialysis, Neighborhood psychological health and wellness solutions, Comprehensive outpatient recovery solutions, Other services not covered by Part A Screening mammogram - Medicare will cover a diagnostic mammogram when the doctor has specific factors for ordering the test or once a year.

The Definitive Guide to What Is Medicare (Part D)

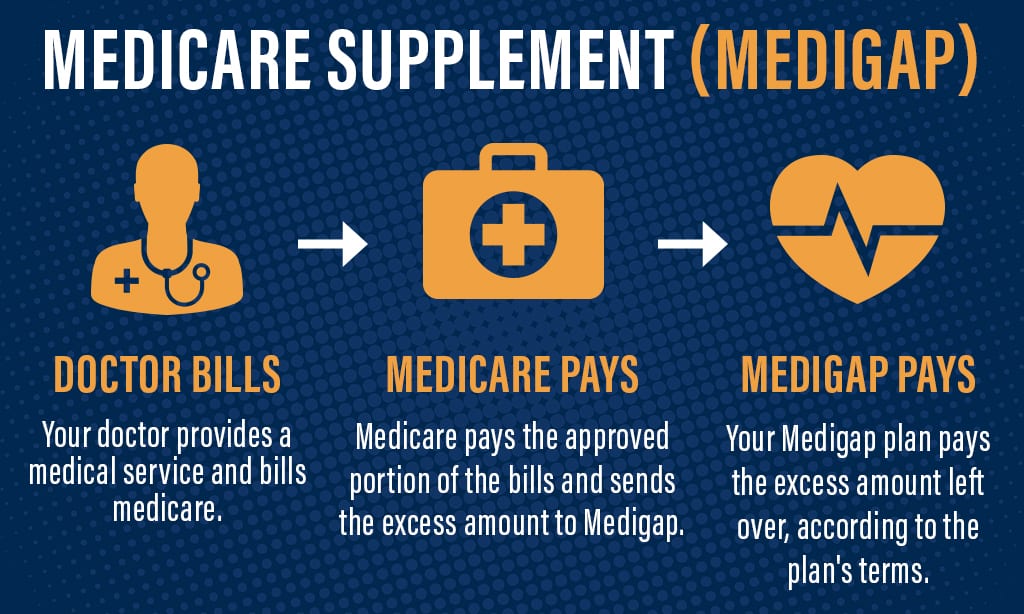

Medicare was never ever meant to pay 100% of clinical costs. Its objective is to assist pay a part of clinical costs. Medicare beneficiaries additionally pay a section of their clinical expenses, that includes deductibles, copayments, as well as services not covered by Medicare. The quantities of deductibles as well as copayments transform at the start of every year.

You would certainly be responsible for paying the additional charge (or restricting charge) as well as any type of copayments. Some Medicare Supplement policies assist pay Component B deductibles as well as Copayments.

Nevertheless, some individuals might not wish to request Medicare Part B (Medical Insurance Policy) when they become eligible. You can postpone registration in Medicare Component B scot-free if you fit among the following classifications. If you transform 65, remain to work, and are covered by an employer team wellness plan, you may wish to postpone enlisting in Medicare Component B.

If you transform 65 and also are covered under your working partner's company team health insurance plan, you might desire to postpone signing up in Medicare Part B. Note: Group health insurance of companies with 20 or even more workers must provide spouses of active employees the same health and wellness advantages no matter age or health status.

The Best Guide To What Is Medicare (Part D)

If you have severe pain, an injury, or an unexpected health problem that you believe may cause your health major danger without prompt care, you deserve to obtain emergency situation treatment. You never ever require prior approval for emergency treatment, as well as you may obtain emergency treatment throughout the United States.

If you are signed up in an additional Medicare health insurance plan, you can appeal the plan's denial for a solution to be given. You deserve to find out about all your health and wellness care therapy alternatives from your healthcare service provider. Medicare forbids its health insurance from making any rules that would stop a doctor from informing you every little thing you need to recognize about your healthcare.

How Does A Medicare Part D Plan Work? Fundamentals Explained

The right to information concerning what is covered as well as just how much you need to pay. The right to pick why not find out more a females's wellness professional. The right, if you have a complex or serious medical problem, to receive a treatment strategy that consists of straight access to professionals.

The strategy covers individuals age 65 or older, younger ones with handicaps, and also individuals with end-stage kidney disease. Medicare is made up of several strategies covering specific facets of health and wellness get more care, and some come at an expense for the insured.

Anyone with ALS automatically gets approved for Medicare, no matter of age. Premiums for Medicare Part A, which covers hospital stays and various other inpatient care, are totally free if the insured person or their partner contributed to Medicare for 10 or even more years with their pay-roll taxes. You are accountable for paying costs for various other parts of the Medicare program.